Selling to the CFO: Prepare Sellers to Answer These 5 Questions

Categories: Sales Conversation | Economic Change | Selling to the C-Suite

The Chief Financial Officer is an influential voice in any sales conversation. If you’re looking to drive growth for your organization, your reps must be able to influence the CFO to close higher-value deals. Recently, due to economic pressure and budget constraints, many sales teams are seeing CFOs get involved in every deal, regardless of size. The ability to sell to the CFO is now a crucial skill every seller needs in order to hit revenue targets in today’s market.

Jim Kelliher, former CFO of Drift, recently joined Ascender by Force Management for a discussion to share The 5 Questions He Asks in Every Deal as a Financial Decision-Maker. Today, we’re breaking down how sales leaders can better equip their team to answer these 5 essential CFO questions:

1. Is it budgeted?

The budget owner is a crucial stakeholder that should be identified early in the process - in the case that they are not the CFO, they are likely an ideal champion. Even if the seller is not directly selling to the CFO, it’s critical that they identify and leverage someone who has influence with the CFO to answer these pertinent questions. Accessing this kind of champion early and coaching them to sell on your behalf is one of the most relevant skills a seller can have in today’s market.

Enable sellers to identify champions who influence the deal by:

- Training your team to drive deep, meaningful discovery conversations

- Documenting a process for mapping the political landscape of the buyer organization

When considering the CFO perspective, it’s important to identify what kind of fiscal reputation a potential champion has. Do they have a history of good or cautious investments? Are they frequently asking for additional budget allocations? Understanding these nuances of the buyer organization will enable your sellers to navigate deals with fewer surprises.

2. The 3 Whys: Why do we need this? Why from you? Why now?

In general, CFOs are concerned with 3 main goals: optimizing for IPO readiness or shareholder satisfaction, increasing productivity and cost efficiency, and driving overall profitability. It’s critical that sellers are speaking to outcomes that fall in these three categories when selling to a CFO, directly or through a champion.

Particularly in a tight economy, sellers must find and attach to the biggest business issue that’s keeping the buyer from executing on their strategy. This is the only way to create urgency and emotional attachment from decision-makers and move the needle in an indecisive buyer’s market.

To enable sellers to create urgency and differentiation for your solution, leaders should create a culture and language of alignment around these essential questions, ensuring that their answers are adjusted to be relevant to the buyer’s current economic situation:

- What problems do we solve for the customer?

- How specifically do we solve these problems?

- How do we do it differently than the competition?

- What proof do we have of how it’s worked for other customers?

3. What is the expected impact?

Appealing to a CFO’s priorities is crucial to closing a high-value deal. These are the 3 metrics that CFOs are always looking at to make decisions, according to four-time CFO Jim Kelliher:

- Growth (Total Bookings and Net New Logos)

- Productivity/Ramp-Up Time

- Net Customer Retention Rates

In order to drive a larger deal size, it’s important that sellers convey how your solution impacts positive business outcomes in these core metrics from the early stages of the deal. Sellers get delegated to who they sound like, so speaking to C-level business issues can help them reach higher decision-makers. Laying this groundwork will also equip internal champions to sell on their behalf.

Enable your sellers to convey ROI that sways the CFO by:

- Aligning your sales team on a value messaging framework that empowers them to sell higher in the organization

- Generating quantitative proof points of the results you’ve driven for other customers, and train sellers to maximize the use of these results

4. Who will own the implementation and who does it affect?

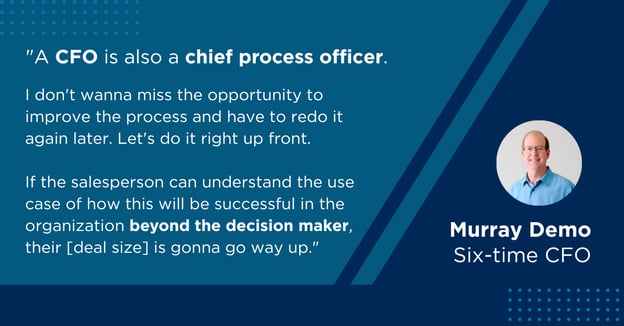

Implementing a new process or technology can be costly - not just in the purchase price, but in downtime and lost productivity for ramp-up time. CFOs are interested in efficiency. They want to know not just the value of the solution, but on what timeline they can expect that value. Here’s how six-time CFO and Board Director Murray Demo describes his role on an episode of the Revenue Builders Podcast:

To sell to the CFO, reps need to be prepared to fully understand the current process and explain how your solution will efficiently and seamlessly draft into that process. They should work to construct a 30, 60, 90-day plan with the internal implementation owner and your customer success team before the deal reaches the CFO.

Here’s how to support your sellers in addressing implementation concerns:

- Emphasize the importance of integrations and customer success, as well as using deep discovery to fully understand current processes

- Provide a template for demonstrating quick wins, outlining short-term goals and identifying leading indicators of success

5. Are we getting a fair price?

CFOs are not typically interested in buying the cheapest solution. They are interested in getting the best overall outcome for their organization, at a price that makes sense for the return on investment. This is why it’s crucial that sellers are able to justify their price. Price justification happens by executing great negotiation that starts from the very first sales conversation.

Enable sellers to justify a premium price and preserve margin by:

- Aligning your team on a message of value that’s relevant to your customers’ economic state and current priorities

- Training on “early and often” negotiation

- Generating great proof point content that demonstrates ROI you’ve provided for other customers

If your seller reaches the CFO and hasn’t adequately demonstrated the ROI of your solution, one of three things is likely to happen: you’ll end up discounting, you’ll lose out to competition who did justify their price, or you’ll lose the deal to no decision.

Empower Your Sellers to Close High-Value Deals

Hitting revenue goals in a tough market is all about elite execution of sales fundamentals and staying highly efficient. Elite sales organizations are doubling down in high-impact areas to maintain momentum during this time. We created a playbook with the top 5 most impactful strategies for sales leaders right now. Download it now and get started on your plan to recession-proof your revenue.